Equity Protection

Invest with prudence

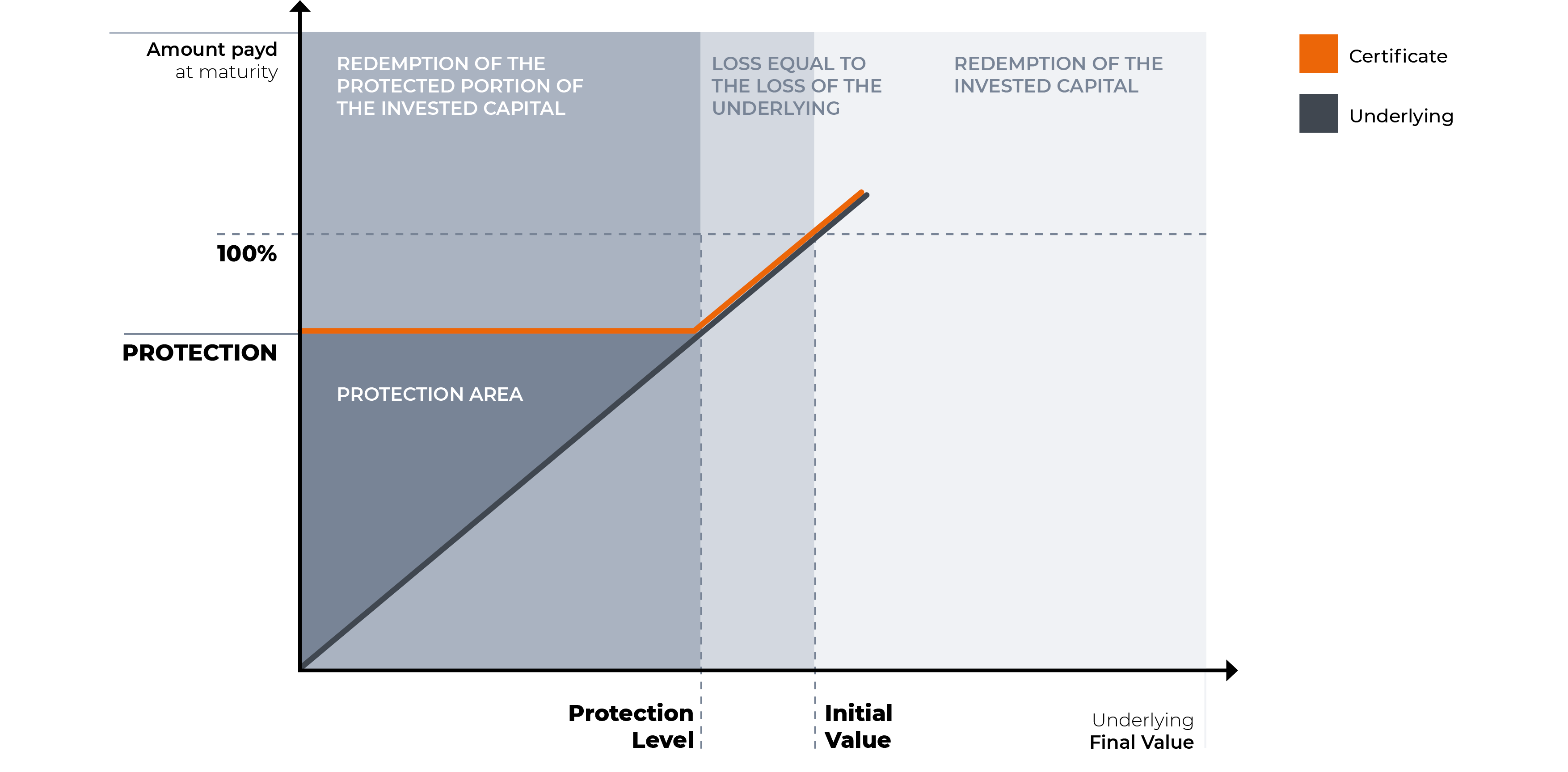

Equity Protection Certificates allow holders to benefit from the positive movement of the Underlying Asset while simultaneously protecting the capital invested at maturity, limiting or eliminating losses even if the market declines below certain thresholds.

Suitable for investors who believe there will be an upward trend in the market, even moderate, who at the same time want to invest prudently, protecting their capital and knowing the maximum loss to which they could be exposed.

On the Initial Valuation Day, the Initial Value of the Underlying is identified. The Protection Level, based on the Initial Value, is the threshold below which the capital is always protected, even with further declines in the Underlying.

At maturity, the amount redeemed for each Certificate is calculated according to the following scenarios:

| 1. | If the Final Value of the Underlying is equal to or greater than the Protection Level, the Certificate will repay a percentage of the Nominal Value equal to the Protection increased by the stake in the percentage variation of the Underlying Asset with respect to the relevant Protection Level. |

| 2. | If the value of the Underlying is below the Protection Level, the Certificate will repay the percentage of the Nominal Value equal to the Protection. |

CAP

the maximum percentage of the Nominal Value that investors can receive as payment at maturity.

UPWARD PARTICIPATION

the percentage stake in the rise of the Underlying can be customised.

STRIKE

at maturity investors can have a stake in the rise of the Underlying at that level.

AUTOCALLABILITY

investors can receive repayment of the invested capital even before the maturity date, if the Underlying is above set levels on agreed dates (Early Repayment Event).

DIGITAL COUPON

a conditional coupon whereby investors can receive fixed periodic returns if the Underlying reaches set values on set dates (Digital Coupon Event).

LOCK-IN COUPON

investors can receive unconditional fixed periodic returns if the Underlying reaches set values on set dates (Lock-in Coupon Event).

UNCONDITIONAL COUPON

investors receive an amount independent of the movement of the Underlying on dates agreed in advance.

PERFORMANCE COUPON

a conditional coupon whereby investors can receive periodic returns indexed to the performance of the Underlying if the Underlying reaches set values on set dates (Performance Coupon Event).

MEMORY MECHANISM

in addition to the due Digital Coupon, investors are also entitled to receive the previous unpaid ones.