Equity Premium

Increase the potential

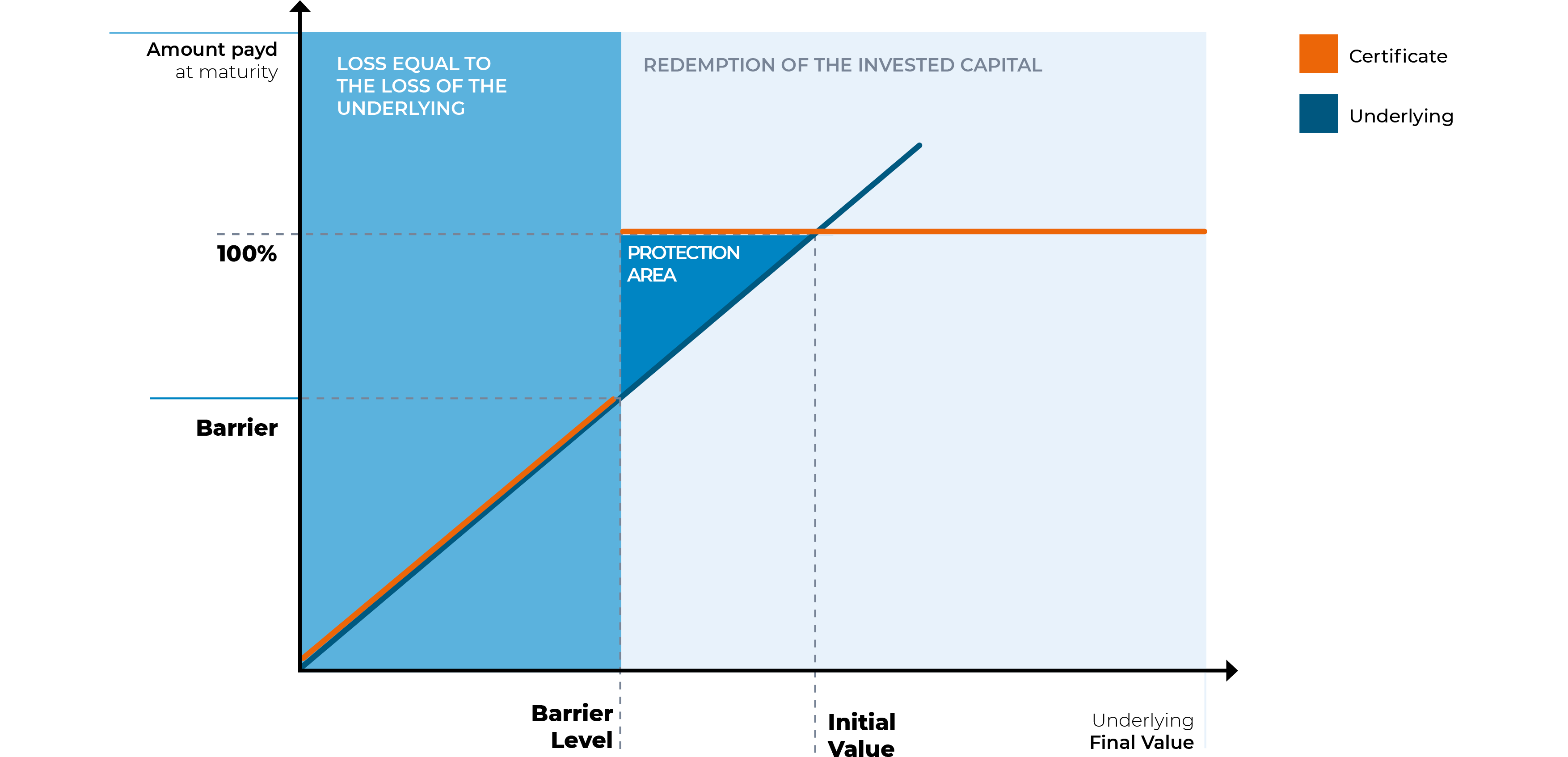

Equity Premium certificates conditionally protect the capital at maturity: the nominal value is repaid in full, even if the Underlying is less than the Initial Value, provided it has not reached the Barrier Level.

In the case of Reverse Equity Premium, investors receive repayment of the invested capital at maturity, even if the Underlying has moved in a positive direction, up to a set level.

Suitable for more experienced investors who wish to take advantage of sideways market movements and who are prepared to bear losses in adverse scenarios.

On the Initial Valuation Day, the Initial Value of the Underlying is identified and the Barrier Level (equal to the product of the Initial Value and the Percentage Barrier), which is the level below which investors could be exposed to losses.

At maturity, the amount redeemed for each Certificate is calculated according to the following scenarios:

| 1. | If the Final Value of the Underlying is equal to or greater than the Barrier Level, the Certificate will repay the invested capital in full. |

| 2. | If the value of the Underlying is below the Barrier Level, the Certificate will replicate the movement of the Underlying, repaying the Nominal Value minus the negative percentage change. |

MINIMUM REPAYMENT

the minimum percentage of the Nominal Value that investors can receive at maturity.

STRIKE

at maturity, investors can have a stake in the rise of the Underlying at that level.

CAP

the maximum percentage of the Nominal Value that investors can receive as payment at maturity.

UP STAKE

the percentage stake in the rise of the Underlying can be customised

AUTOCALLABILITY

investors can receive repayment of the invested capital even before the maturity date, if the Underlying is above set levels on agreed dates (Early Repayment Event).

CAPITAL LOCK-IN

at maturity, investors can receive full repayment of the invested capital if the Underlying exceeds set levels on agreed dates (Capital Lock-in Event).

DIGITAL COUPON

a conditional coupon whereby investors can receive fixed periodic returns if the Underlying reaches set values on set dates (Digital Coupon Event).

LOCK-IN COUPON

investors can receive unconditional fixed periodic returns if the Underlying reaches set values on set dates (Lock-in Coupon Event).

UNCONDITIONAL COUPON

investors receive an amount independent of the movement of the Underlying on dates agreed in advance.

PERFORMANCE COUPON

a conditional coupon whereby investors can receive periodic returns indexed to the performance of the Underlying if the Underlying reaches set values on set dates (Performance Coupon Event).

MEMORY MECHANISM

in addition to the due Digital Coupon, investors are also entitled to receive the previous unpaid ones.